Personalized Video for Pensions & Retirement

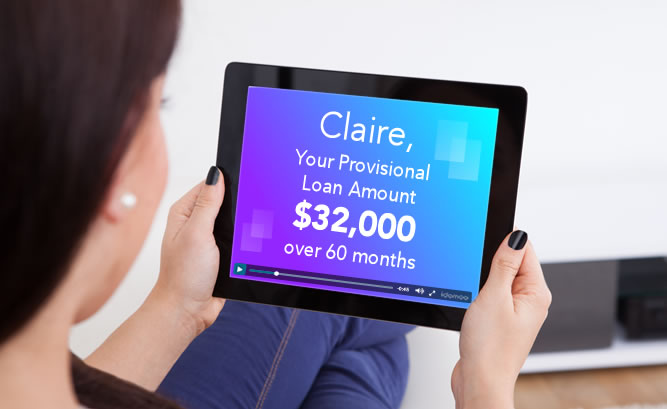

Saving for retirement is critical, but most people put it off. How do you change that? One study shows employees who received a Personalised Video were 2x as likely to activate their pension account. Help people visualise the future — their future — so they make better decisions today.

Send personalized statements your customers will actually pay attention to — by putting it in an easy-to-watch video. When people understand their pension, they save more and call you less.

Year-in-review videos can be particularly insightful, giving customers the big picture on their savings and how they compare to their peers. Then show them how next year can be better if they up their savings rate.

With ever-changing global and local regulations, transparency is more important than ever. Ensure you are doing all you can to provide clarity to your customers using the power of Personalized Video.

Idomoo is also a leader in ADA compliance for video content, ensuring no customer is left behind.

Help your customers understand the importance of saving for retirement by showing them. When people visualize their future, they’re 31% more likely to save.

With Living Video, viewers can input what matters to them — their target retirement age, savings goal, risk tolerance and more — to instantly generate a new video showing exactly how much they need to save.

Then make it easy for them to save with a CTA to change their contribution, right from the video.

Changing jobs is a busy time, and keeping track of your pension is just another complicated detail to handle amid all the paperwork.

Make it simple. Show them how to merge their old and new retirement accounts with a video that walks them through the process — personally. It’s a surefire way to increase rollover retention rates while helping customers.

Client Results in Pensions & Retirement

Join today’s leading pension providers who are motivating people to save for retirement

with the power of Personalized Video.

in conversions

to change contributions

contributions

activations

Client Testimonial

Related Articles

The Psychology of Retirement Savings (And How Video Helps)

What does choosing between eating a banana or chocolate have to do with retirement savings? It may seem like an odd question, but it actually holds key insight into the psychology behind our financial decisions.

How Standard Life Boosts Contributions With Data-Driven Video

It’s no secret that pensions can be complicated. And when savers fail to understand their pension, they’re unlikely to engage with it. To tackle this issue, top pension provider Standard Life is simplifying complicated topics with data-driven videos. The campaign, launched in collaboration with BT’s Division X Messaging Team and powered by Idomoo, has seen great results — specifically, viewers were 4x more likely to change their contribution than non-viewers. The Issue The pension industry is struggling to engage members. But just how serious is the issue? A look at the numbers is telling. Only 20% of savers feel confident they have enough for retirement. Unclaimed pension pots are now equal to an estimated £19.4 billion. In response, the Association of British Insurers and the Pensions and Lifetime Savings Association have launched a new Pension Attention campaign this fall with the support of 13 top providers. The campaign aims to

Winning Pension Attention: A New Challenge for Providers

Unclaimed pension pots are now equal to roughly £19.4 billion, according to the Association of British Insurers. But people aren’t just misplacing their pension pots — they’re forgetting about them. Pension awareness is alarmingly low, and it’s become a huge threat to the financial futures of savers everywhere. Just 20% of individuals are confident they’re saving enough for retirement. To tackle this issue, providers and schemes across the U.K. are coming together and supporting the Pension Attention campaign: a cross-industry campaign led by the Association of British Insurers (ABI) and the Pensions and Lifetime Savings Association (PLSA) to boost awareness around people’s pensions. From creating clear messages to leveraging an omnichannel approach, we’ll share how providers and schemes are winning over the pension attention of today’s savers. Clarifying Messages With Video The best way to help people pay attention to their pensions? Help them understand it. Unfortunately, pensions can be

Clear Communication in Financial Services: The New Mandate

The FCA is raising the bar for customer care in the financial services landscape. Firms must now adhere to the Consumer Duty: a package of measures that aims to improve customer outcomes with better communication. This new Consumer Duty, recently issued by the U.K.’s Financial Conduct Authority (FCA), mandates that information must be easy for customers to see, rather than buried in paragraphs of text. Jargon must be swapped for easy-to-follow language. With clear, transparent communication, customers will be able to make more informed choices and see improved outcomes, especially critical during a time of financial uncertainty for many. It’s a big deal — a “paradigm shift” regulators are calling it. How these rules are put into practice is up to every firm. But one thing is certain: communication must be digital. Today’s customers are always online, and better communication starts with reaching customers where they are: on their phones,

Pension Inertia? Communicate Better To Drive Engagement

Retirement planning is alarmingly low worldwide. In the U.S., nearly 60% of employees do not have a retirement account. Across the pond, only 43% of U.K. employees are confident they’ll retire at the age they want. The current solution? Automatically enroll employees in a pension fund. But auto-enrollment fails to get to the root of the issue: most members forget about their plan once they’re set up. In the past year alone, 67% of UK members did not log into the account. Providers are now facing pension inertia, where members have a plan — but never make changes to it. This lack of member engagement comes with consequences. Savers are missing out on opportunities to make the most of their plan. Even worse, they’re at risk falling into a retirement savings gap. To improve engagement, pension providers need to reach today’s digital-first members with digital communications that empower them to

How Personalization Builds Consumer Trust Across Industries

Building trust with your customers is one of the most effective ways to retain customers long-term and benefit from their word-of-mouth referrals. Every business wants to score customers for life — and trust is key to locking in those relationships.

Helping Mercer Engage Employees

Ask most people about their pensions and their eyes glaze over. It’s all too complicated, you hear them say, for somebody who isn’t a pro… And this is despite 90% of employees ranking pensions as one of their most important benefits. But pensions are complex, driving engagement levels as low as 10%. And in the pensions world, low engagement equals low contributions.

Let’s Talk

See how Idomoo helps leaders in pensions and retirement improve contributions and 1:1 digital customer service. Fill out the form and we’ll be in touch.