Personalised Video for

Insurance

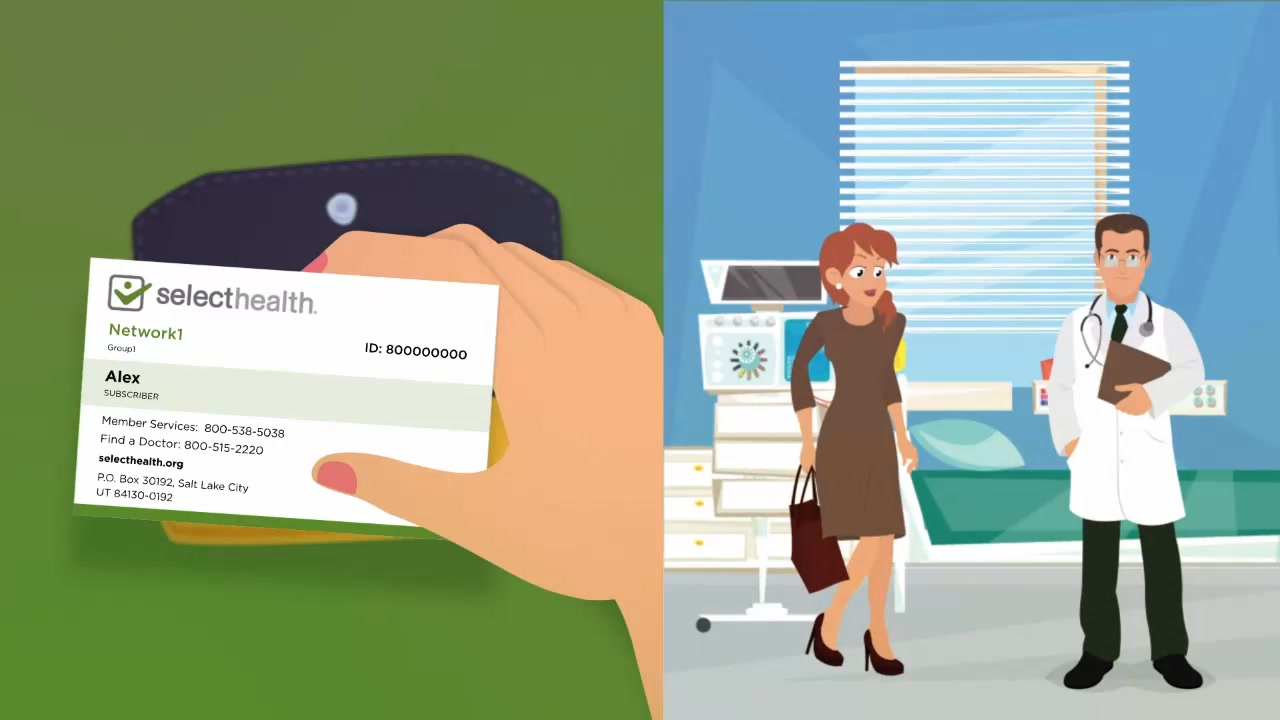

Starting coverage can be confusing to many people, but Personalised Video makes it easy.

Welcome new customers to their policy and explain details of their coverage or how to access their online account.

It’s also a great time to proactively answer common questions, exceeding customer expectations and averaging a 4.5-star satisfaction rating.

Personalising isn’t only about what you say — it’s also about when you say it. Step in with timely, personalised communications when you know the risk of customer churn is highest.

Sending a video before your customer’s policy renewal lets you remind them of all the great benefits they enjoy with their coverage. It also makes sure they don’t forget the renewal deadline, so there are no surprises down the road.

A Personalised Video can turn a point of friction into an opportunity to show transparency and empathy.

For a customer struggling with the claims process, a video that walks them through their next steps — clearly and visually — can be a lifesaver. It lends a human touch to the experience while reducing the burden on your call centre.

Start with what you know about your customers to send them the most relevant offers. Then make it engaging with video. A Personalised Video isn’t an “ad.” It’s a story tailored to the individual.

With Living Video functionalities, you can easily add interactivity to further increase conversions. Let viewers click to get more info, sign up for coverage and more, all right from the video.

With Living Video functionalities, you can automatically trigger the sending of personalised quote videos to prospects, based on the information they entered in real time.

Want to go after new leads? Take advantage of Facebook’s niche audience targeting with our Dynamic Video Ads for Facebook and Instagram, boasting up to 7x return on ad spend.

Client Results in Insurance

Join the ranks of industry leaders like Zurich, AXA, Liberty Mutual and others who have seen

incredible results with Personalised Video.

in sales

engagement

rating

Client Testimonials

Related Articles

Building Customer Relationships in the Insurance Industry

Gone are the days of customers choosing to work with an insurance company simply because there aren’t any other options. We don’t just get our news from word-of-mouth meetups with friends anymore, just as we don’t choose our insurance or financial companies based on who is available in our area. Instead, choosing to work with an insurance company is a longer, more thought-out process. Potential customers consider everything from a company’s online reviews to their customer service to their policies and price. Because of this, it’s more important than ever to build customer relationships that are personal, trustworthy and will stand the test of time. Let’s dive into why insurance companies should prioritize building relationships throughout the customer journey and how to get started. What Does a Customer Relationship in Insurance Involve? Customer relationships in the insurance industry are the emotional connections and trust built between insurance providers and their

How Personalised Video Improves the Insurance Customer Experience

As every insurer today knows, the rise of digitalization and the always-on consumer has created a highly educated pool of fickle customers. Customers want information and resources tailored for them and available when they need them, 24/7. They don’t want to read through swathes of text or struggle to find what’s relevant to their needs and situation. Businesses that meet these demands deliver a superior customer experience, which often makes the difference between churn and long-term loyalty. That’s where Personalized Video comes in. It’s the closest thing you can get to sitting down with your customer 1:1 and talking them through their coverage, how to make a claim, a new offer or anything else you might need to say. It’s personal because people are personal. It’s time insurance companies started approaching the customer relationship as a relationship, an ongoing journey rather than a transaction. This leads to not just loyalty

How Personalisation Builds Consumer Trust Across Industries

Building trust with your customers is one of the most effective ways to retain customers long-term and benefit from their word-of-mouth referrals. Every business wants to score customers for life — and trust is key to locking in those relationships. When a consumer trusts a brand, they’re more likely to: Purchase: 63% of consumers say they would buy a trusted brand’s new products and even buy from the brand when it’s more expensive than competitors. Stay loyal: 55% say they wouldn’t shop around for other brands, even if the brand makes a mistake or is accused of wrongdoing. Advocate: 53% would recommend the fully trusted brand to other people. Building this trust has become even more crucial recently. According to Edelman, 71% of consumers say it’s more important to trust the brand they buy or use today than in the past. This trend is especially pronounced among Gen Z, with

Customer Engagement in Insurance: Challenges and Solutions

Whether it’s digital innovation or a global pandemic, the world is always changing and bringing with it new challenges. For insurance companies, which have already been struggling to keep up with the speed of new innovations, identifying the obstacles ahead will be vital for success. For instance, McKinsey & Company recently found that more than 30% of insurance customers are dissatisfied with the digital channels available. Meanwhile, insurtech and other financial players are shaking up the competition with their offerings, pushing traditional insurers to rethink their customer engagement approach. But no obstacle is too great as long as you have the right strategies and tools in place. From embracing digital communications to prioritizing CX, here’s how to overcome today’s biggest engagement challenges in the insurance industry. Engage With the Digitally Savvy Insurance Consumer With technical know-how and an abundance of information at their fingertips, the digitally savvy consumer — including

The Ultimate Guide to Hyper-Personalisation in Insurance

Insurance companies, along with other financial services industries, have wrestled with two important questions in recent years: How do we attract new customers and keep them engaged, and how do we stay competitive in our market? Our answer to these questions? Hyper-personalization. Personalized messaging can help insurance companies reach younger audiences, improve customer engagement and stay ahead of the competition. What is Hyper-Personalization? Hyper-personalization is a form of personalization that leverages data and often artificial intelligence (AI) to deliver highly customized experiences to individuals. Unlike traditional personalization, which might involve simply addressing a customer by their name in an email, hyper-personalization goes several steps further. It involves analyzing a vast array of data points — from customer behavior and preferences to things like transactional history and social media activity — to create experiences uniquely tailored to each individual. Hyper-personalization is all about understanding customers on a deeper level and anticipating

Next Gen Video Awards 2023: Best Results, Creative and More

For the past four years, Idomoo has celebrated the best videos our team and tech helped create for the world’s leading brands. This year, we want to share with you a few of the winners from our annual Next Gen Video Awards. These are the ones that stood out to our illustrious internal judges as not just great videos — the internet already has plenty of great videos — but as truly effective applications of dynamic video to spark meaningful engagement between brands and customers. So without further ado, here are our winners in each category along with what made the video stand out. We hope it inspires your next campaign! Best Recap Video We love a good personalized recap. While the year in review is the most common use case, we’ve created personalized recaps covering everything from a month to a decade. These custom showreels — able to recap

Clear Communication in Financial Services: The New Mandate

The FCA is raising the bar for customer care in the financial services landscape. Firms must now adhere to the Consumer Duty: a package of measures that aims to improve customer outcomes with better communication. This new Consumer Duty, recently issued by the U.K.’s Financial Conduct Authority (FCA), mandates that information must be easy for customers to see, rather than buried in paragraphs of text. Jargon must be swapped for easy-to-follow language. With clear, transparent communication, customers will be able to make more informed choices and see improved outcomes, especially critical during a time of financial uncertainty for many. It’s a big deal — a “paradigm shift” regulators are calling it. How these rules are put into practice is up to every firm. But one thing is certain: communication must be digital. Today’s customers are always online, and better communication starts with reaching customers where they are: on their phones,

Let’s Talk

See how Idomoo helps the world’s leading insurance companies grow and engage their customer base. Fill out the form and we’ll be in touch.