Last month, the well-known free-trading app Robinhood filed its IPO, a move that is set to make its owners billionaires. Its success is just one example of how app-based financial companies aiming to demystify finance are seeing their efforts prove fruitful.

Fintech companies, who use new technology to disrupt the financial industry by providing improved experiences, have seen their growth potential jump. According to The Economist, venture capitalist funding of fintech reached a record-breaking $34 billion in the second quarter alone, with one in every $5 invested by VCs going to fintech this year.

Traditional retail banks are also paying attention. Knowing the growing popularity of fintech, they’re spending more to compete and are investing in technology that can help them keep up with the benefits that these competitors offer, not the least of which is greater transparency.

Transparency Fosters Trust and Empowerment

Asking consumers about their financial dealings, Forbes and Statista established a list of the banks and credit unions with the most satisfied customers based on trust, terms and conditions, branch services, digital services and financial advice.

Only 2.6% of all banks and 3.5% of all credit unions made the list, suggesting that there is plenty of room for improvement by most players in the industry. And with fintech companies continually making new waves on the playing field, the competitive landscape is getting tougher.

Today, customers have more product choices than ever when it comes to financial services. They won’t hesitate to switch companies — or publicize their grievances in the process.

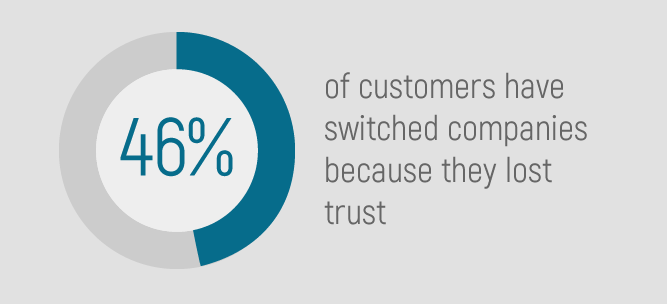

To avoid losing business, companies have to prioritize establishing and keeping the trust of their customers. According to a global Accenture study, 46% of customers switched companies because they “lost trust,” which happens when companies don’t deliver on their promises and fail to be transparent.

The importance of establishing trust is particularly critical for financial services, which deal with the sensitive object of money. To do this, transparency must be prioritized. But how?

Remember that being transparent means little if what is being presented can’t be understood by the customers or doesn’t help and empower them. Ultimately, being transparent means being clear about your intentions and delivering what customers expect. No secrets. No hidden agendas.

5 Ways Financial Services Can Show Transparency

If you want your customers to trust you, show them that you genuinely have their best interests at heart at every step of the customer journey. Here are some tips and strategies to drive transparency, plus some of the digital tools you can use to do so.

1. Be Vigilant in Protecting Consumer Privacy

Amidst reports of data breaches and cyberattacks, having control over personal data is a critical concern of most consumers today. Financial services need to be transparent and proactive regarding all aspects of consumer data usage, collection and storage.

The best (and, in some cases, required) practices as advised by Bloomberg are:

- Data mapping and inventory

- Compliance with consumer rights requests

- Privacy disclosures and notices

- “Reasonable” security measureы

- Cyber insurance coverage

When you’re working with vendors, make sure they adhere to the same security standards you set for yourself. And this shouldn’t just be an unbacked claim of “we’re secure.” Look for certifications from official bodies, such as the ISO 27001 certification from the International Organization for Standardization.

Trend alert: Financial institutions are increasingly using blockchain to house records, authenticate identity and data, and more. Combining cryptography with open databases, the technology is ideal for balancing privacy with transparency.

2. Keep It Simple and Accessible

Remember that real transparency includes understanding. Finance can be complex, so be sure to deliver your services and communications in a way that’s easy for your customers to comprehend.

Avoid using industry jargon that may be unclear to anyone unfamiliar with financial topics.

Leverage popular mediums, like video or infographics, to get your message across in a way that your customers will find easier and more enjoyable to consume.

3. Don’t Forget Customer Service

A key part of building trust is being there for your customers and readily addressing their concerns.

- Be honest and clear. Financial services, especially, needs to work on this. After all, we’re talking about people’s personal wellbeing, things like their health insurance, plans for retirement, savings, the mortgage on their home and more.

- Be available. Call centers are expensive and not always effective. You can optimize and improve customer service — and transparency — with the right digital tools.

Post on

Companies that take customer service online with self-serve tools can provide immediate transparency to customers who have questions and concerns. And by making these resources personalized and interactive, the customer’s unique needs are addressed in a format that’s easily understandable, even enjoyable.

Yes, we just said customer service could be fun.

One example is this interactive video that deals with mortgage forbearance. The homeowner can click to schedule their payment, extend forbearance or learn more about topics like repayment and loan modification. And all of it comes with personalized data, such as due dates and payments owed, so everything is 100% clear for the viewer.

Quick stat: One company that used the template video above saw a 73% drop in call center volume.

Though more complicated matters may need to be handled by a real person, self-serve tools not only improve the customer experience but alleviate the pressure on service departments so that they can be better prepared to solve bigger problems.

4. Regularly Deliver Personalized and Helpful Information

When it comes to finances, staying informed, whether it’s about your spending activity or the performance of your investment, can make all the difference.

No one wants to feel like they’re not in control of their finances. What can you do? Empower your customers by regularly sending them important information. Make sure these communications are tailored just for them — it shows both your dedication to transparency and to them as valued customers.

Popular ways to do this are recaps or year-in-review content that gives customers an overarching picture of their activity. See how Navy Federal summarized their customer’s spending and point earning in the Personalized Video below.

5. Promote Financial Wellness (Now and in the Future)

Financial services can win the trust of their customers by supporting them on their journey to improve and achieve financial wellness.

The Financial Therapy Association says financial wellness is about three things.

- Financial literacy: Knowledge about finances

- Financial behavior: Decisions made regarding money

- Internal emotions towards money: How you feel or think about money

Companies can provide personalized tips and resources that encourage healthy and positive habits surrounding those three factors.

Give your customers practical advice to improve their finances, whether it’s teaching them budgeting strategies, providing resources on how to invest smarter or sharing a blueprint for savings. You might also show transparency by highlighting discounts you offer or services customers aren’t taking full advantage of.

To make this content even more engaging, add storytelling like the campaign below from BBVA, starring a main character everyone cares about — themselves.

That’s one way to get people saving for retirement, right?

Ensure Transparency Now and Going Forward

Personalized Video is just one digital tool financial services can leverage to drive transparency, but it’s a powerful one. Complex financial topics become much easier to understand when presented in video form, while personalization ensures that your customers are receiving relevant and helpful content.

Learn more about all the ways Personalized Video can help your company strengthen consumer trust and boost business in financial services, whether it’s banking, mortgages, insurance or pensions and retirement. Or if you’re ready to dive into a demo with an Idomoo expert, schedule a quick call by clicking below.